Worried About Your Refund? The Self-Employed Guide to Federal Taxes

/It's this time of year that I find myself wading into the icky sea that is our tax code. I'm in no way an expert at taxes, but every year I learn a smidge more. And with every smidge of learning I stop and go "wow, capitalism is f'ed up." So today I bring you my latest installment. Please do not construe this as tax advice; this is for educational purposes only. Your situation may be different so consult with your tax professional.

The fundamental fact I'm diving into today is that if your labor makes money, it's taxed through the nose. But, if your money makes money, it's taxed more mildly. Taxes do serve a function, yet billionaires often get $0 tax bills which is pretty unfair. Our tax code benefits the ones who wrote it: old white guys. I'm a huge proponent of working collectively to change our laws. And in the meantime, if we understand how it works we can leverage it to our own benefit to the extent that we're able.

When Labor Makes Money

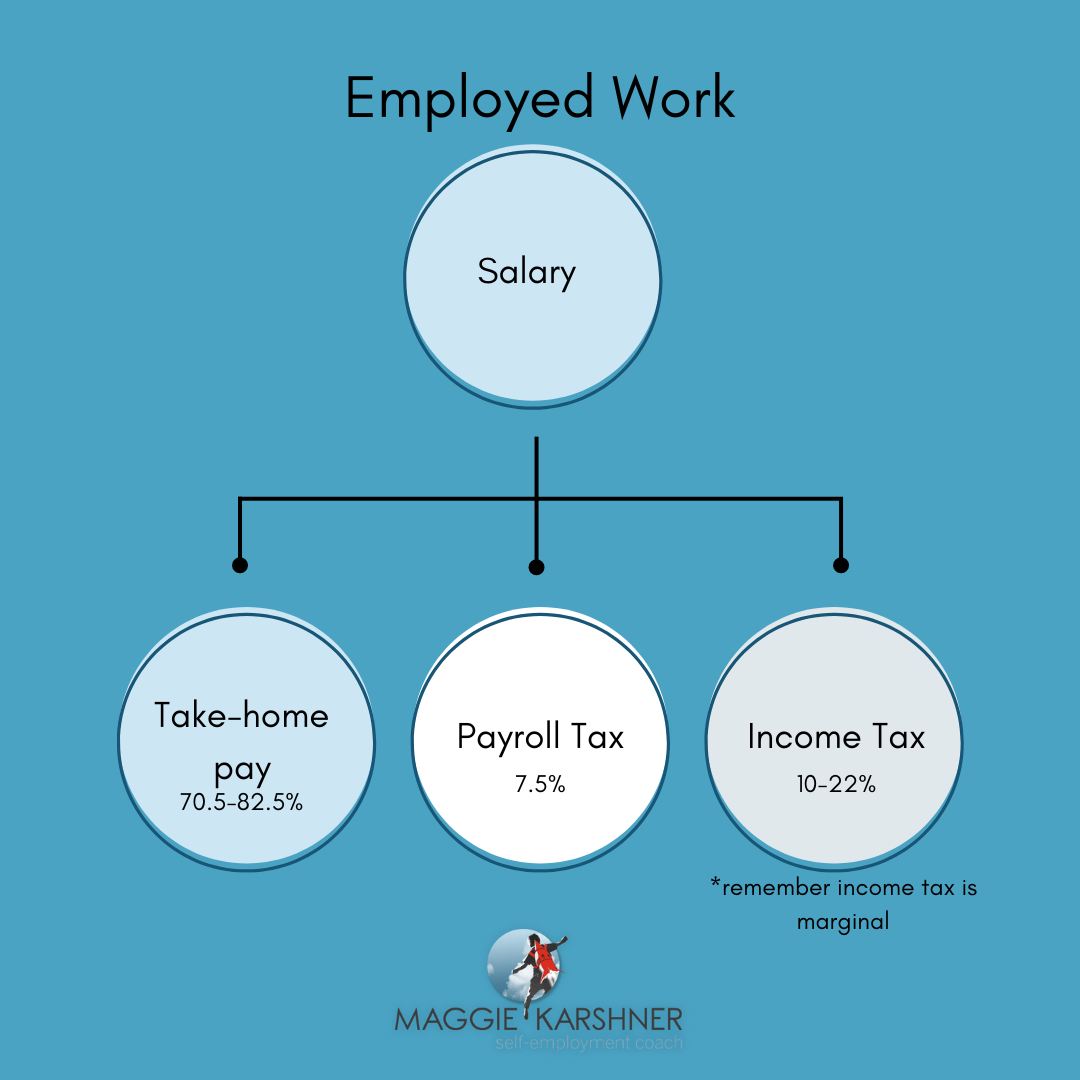

Everyone who's ever been employed is familiar with the taxes applied to labor. In employed work, you know that your salary and your take-home pay are two different things. The gap between these consistently includes payroll taxes and withholding for income taxes. It can also include your contribution to any benefits provided by your employer, if applicable. You can count on a steady paycheck that is 20% less than what your employment contract states.

In self-employment, there is a similar gap with two key differences. First of all, those taxes, bennies, and withholdings are not taken out with each paycheck. (At least until you elect to be an S-corp.) The closest you come to this is making quarterly prepayments. But sending Uncle Sam thousands of dollars every few months feels bigger and harder to keep track of. Also, it's proportional to the amount you paid in taxes last year. This means the year after a really good year might find you scrambling to make those prepayments. (Even though you'll likely get a refund come tax time!) There are ways to mitigate these challenges, but it'll always be a lot less consistent.

The second difference is that you'll be responsible for covering employer taxes. In employed work, the employer pays 7.5% of payroll tax and the worker also pays 7.5%. In self-employment, there is no payroll, so you're subject to self-employment tax. This is typically quoted as a 15% tax. But this is only 7.5% more than the payroll tax you've been paying with each of your paychecks. When employed you pay half and your employer pays half. Now that you're self-employed you pay both halves. That gap between "salary" and "take-home" is a bit wider. But this isn't what leads to the biggest impact.

Earning Your Whole Salary

The bigger change is that you have to work to secure your whole salary. That means you can't target that take-home number. Your goal needs to be that whole, before-tax salary. Oh, and, you've got to earn the business' overhead too. So, actually, it's more than your salary. Below is a graphic representation of this. I also worked up this free spreadsheet to do your math for you!

Most of us are aware that there are overhead expenses related to operating a business. Conceptually this is pretty straightforward. As I've described it so far it seems daunting. In practice, I notice folks vacillating between two extremes. On the one end are austerity measures. Business owners try to sharply minimize their overhead. It's as if every dollar brought in should be their take-home pay. On the other end of the spectrum, folks try to minimize how much gets taxed. They make everything a business expense or go on a spending spree. These reactions - daunting, restricting, and binging - are signs of overwhelm. To combat overwhelm we need clarity. What's the fundamental distinction between what's "your money" vs. "your business' money?"

Your money is the money that you live your life on. It's after all taxes and after business overhead. Your business' money is inclusive of your money, all taxes, and overhead. When employed your money is just your money. You can’t influence taxes, withholding, and benefits.

Self-employed people get to make choices on money-earning and taxation. You get control over how you make your "sausage." If you think of every dollar spent on taxes or overhead as your money, it's like seeing your flesh going into the sausage. It's reasonable to freak out at that! But it doesn't help you make the best sausage. If you can think of those dollars as business dollars it's a lot easier to be calm and strategic. This allows you to make decisions that best nourish you and your business.

So, how do we reinforce the delineation between your money and business money? First off: have dedicated bank accounts for your business! This is a must if you have an LLC but good practice all around. Have all your business revenue go into business accounts. Make sure all your business expenses come out of business accounts. Even credit cards need to be in your business's name and only business purchases go on them.

Secondly, count on not taking home every dollar you earn. If you charge your client $200 for something, it doesn't mean you pocket all $200 of that. You'll pocket closer to half of it, maybe two-thirds if you provide a service and run a tight ship. From the get-go plan on your take-home being about 50% - 60% of your business' revenue. Below is a simplified version of my previous graphic. In this representation, the three layers are condensed into two for simpler calculations.

The Concrete Solution

You've got the conceptual part down, now how do we put this into practice? A simple method is to have your revenue go into one business account and make purchases from a separate business account. This keeps your revenue and expenditures nice and tidy. On a regular schedule clean out your revenue-accumluating account. I like to call this payday. On this day you use your percentages to put your earnings to work. Typically that's 20% aside for taxes, 60% to your personal account, and the last 20% into the business account you make purchases from. This allows you to manage your personal funds in the same way you've been used to. Similarly, business decisions can be made with a glance at your business purchases account. All the while giving you the perspective you need to see business and personal expenses as separate.

Note that these percentages are not hard and fast rules. You'll want to shift those percentages to best serve your situation. Especially if you're at the very beginning and business revenue is more of a hope than a reality. As long as you're setting aside your effective tax rate, the remaining split can be whatever works best for you!

Once you've got consistent revenue, of course, it is wise to optimize how your business spends money. But you can go too far with this. That's why setting aside a set percentage can provide some clarity. For example, it illustrates that your credit card processing fee isn't a big deal. Yes, it's a consistent 2.5-3% of your gross revenue, but you have 17% more of your revenue dedicated to overhead. Or if your web platform stings each month because the monthly fee rivals your hourly rate. You might come to realize that's as little as 1% of your gross revenue. Your business can afford that.

You cannot starve your business into profitability! Every business needs to spend at least a little money in order to operate. In the second tab of my free spreadsheet, I made a math-saver for you! It will calculate how much to set aside based on how much you brought in for a given period.

When Money Makes Money

I want to come back around to when money makes money. Capitalism shines here. It was designed to help money make money, not labor make money. (Is it class warfare? ...not technically the topic of this article...) Getting beyond subsistence levels of money is what allows you to not pay the government as much in taxes. If you have some extra money make sure it's working for you. Invest it in some way that generates returns or at least in a high-yield savings account.

The traditional message for how to get the money that makes money is to save save save! But heaven knows I've never had this be successful personally. If your take-home pay is high enough this is a solid strategy. But this isn't the only strategy available to you when self-employed. Self-employment gives you access to some money-making-money features. In reality, it's all the same work you've been doing but some of it is taxed differently. You can think of it as you're taxed less for the work you do managing the anxiety caused by running a business.

To get access to these money-making-money features your business needs to be grown-up. E.g. when you're comfortably, consistently making your whole living from your business. When you hit that point talk to your tax professional about electing to file your taxes as an S-corp. This election allows you to pay payroll tax on only some of your earnings. There are some expenses to it so you have to be bringing in enough for it to matter. For example, you'll use a payroll system so that you-the-worker and you-the-business-owner can each pay your 7.5% share of payroll tax. A fun mind-puzzle but you'll also have to pay the payroll company to run it. If you're earning enough, you can save in taxes more than the added expenses. Consult your tax professional to make sure it's the best choice for your unique situation.

Are Taxes More Painful in Self-Employment?

Sure, taxes are a different experience when you're self-employed. But it doesn't have to be more painful and you don't have to pay the IRS that much more. However, it is vital to plan ahead. You'll need to set business revenue goals that will take you where you want to go. Then, when your business is up and running, you'll be able to reap the rewards of being a capitalist instead of a laborer. (Giving you more resources to reimagine the whole system!)